The challenges of relying on inheritance to fund retirement

27.02.2019If you’re thinking of using an inheritance to fund your retirement, you’re not alone. However, there are significant challenges to taking this route. Without a back-up plan, it could leave you financially vulnerable once you give up work.

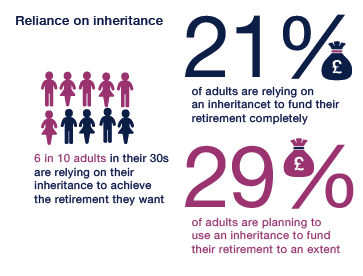

An inheritance can certainly provide a welcome boost to your retirement savings. And as financial pressures mean it can be difficult to save for retirement even when earning an income, it’s an option more are relying on. Across the working population:

- 21% are relying on an inheritance to fund their retirement completely; and

- 29% are planning to use an inheritance to fund retirement to an extent.

It’s a trend that’s even more common among younger generations. For those in their twenties, more than seven in ten intend to use an inheritance to support them throughout retirement; 45% will rely on it completely. Among thirty-somethings, the figure does fall, but six in ten are still relying on an inheritance to achieve the retirement they want.

Planning to use an inheritance to support retirement aspirations can be an excellent use of the gift left by a loved one. However, building your plans around the expectation of an inheritance can be risky for a number of reasons.

You won’t know when you’ll receive your inheritance

One of the key risks when relying on inheritance is that you don’t know when you’ll receive it. Life expectancy is increasing and there are pensioners that will live past the average age. What will happen if your beneficiary lives into their 90s? Would you still be able to fund your desired lifestyle based on the state pension or other provisions you’ve built up?

If the answer is ‘no’, you could be placing yourself at risk if the expected inheritance comes later than you anticipate.

Your loved one’s wishes may change

Over time, our wishes and aspirations change. While you may be included in a loved one’s will now, there’s no guarantee that you still will be in ten or twenty years’ time. Even when you’re close to your benefactor, circumstances and wishes may change. Perhaps welcoming a new family member will mean you receive less of the estate than you expect to now, for example.

If you do intend to use an inheritance to fund retirement, communication is important. Speaking to your loved ones about what you can expect to receive when the time comes, as well as how this may change, can help you plan accordingly.

Your benefactor’s circumstances may also change

Along the same lines, your benefactor’s circumstances may change. There’s no way to predict what’s around the corner. Poor investment choices could mean the portfolio you stand to inherit falls significantly in value. Or the cost of care later in life could substantially deplete total assets. You need to factor in how unexpected events could affect the inheritance you’ll receive, including not receiving an inheritance at all.

An inheritance is not likely to offer a regular source of income

Usually, an inheritance is paid as a lump sum or through assets. Rarely is a person’s estate distributed to provide a regular income to beneficiaries. As a result, this can make it challenging to use inheritance for retirement purposes.

If you’re relying on inheritance, you’ll need to ensure that it can support you throughout your life. It’s important that a sustainable amount is taken annually, reducing the risk of you running out of money in later years. Even if an inheritance is large enough to support you throughout your retirement, you’ll need to come up with a strategy to effectively deliver an income.

Creating a plan B

If you’re planning to use an inheritance to fund retirement, you should ensure you have a plan B to fall back on. In fact, viewing an inheritance as a welcomed boost to your retirement, allowing you to indulge in more luxuries rather than being reliant on it, is advisable.

Without taking your own steps to build retirement provisions, you could end up relying on the State Pension. While the State Pension will often cover the basic cost of living, it’s unlikely to afford you the retirement you want. Even with a full record of National Insurance contributions, the state pension currently pays out £8,436 per year.

With this in mind, starting contributions to a pension or taking other steps to build retirement wealth, even if you believe an inheritance will provide support, is often a wise move.

Please note: A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which is subject to change in the future.

Accessing pension benefits early may impact on levels of retirement income and your entitlement to certain means tested benefits and is not suitable for everyone. You should seek advice to understand your options at retirement.

Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority

All statistics quoted have been taken from our whitepaper, ‘Planning for a brighter tomorrow: the state of the nation’s retirement finances.’

To download our whitepaper, click here.

Search

Search