How the FCA’s anti-greenwashing rules will give you confidence when investing sustainably

16.05.2024The FCA has announced a package of measures designed to improve transparency and consumer trust in sustainable investment products. The terms, sustainable investment and ESG (environmental, social and governance) investing are often used interchangeably.

In response to a recent consultation, new rules will introduce sustainability labels and look to combat rising concerns about “greenwashing”.

This latter issue, of firms making false or exaggerated claims about their ESG credentials, has become increasingly high profile over the last few years. It’s a practice that harms investor confidence, undermines the sector, and (according to Citywire) is at least partly responsible for last year’s record outflows.

Keep reading for a closer look at the FCA’s new requirements, their potential impact on the sector, and the added protections they offer you and your money.

ESG investment is set to grow over the next decade despite a turbulent 2023

A recent Bloomberg report suggests that global ESG assets will exceed $40 trillion by 2030. According to projections, this figure will represent around 35% of assets under management in that year (around $140 trillion).

The forecast comes despite recent turbulence in the ESG investment market.

Citywire confirms that 2023 was the worst year on record for sustainability and ESG funds, with more than $10 billion of outflows during the calendar year.

Challenges facing sustainable and ESG investors include the politicising of ESG performance in the US (at least 165 anti-ESG bills were introduced in 2023, according to Visual Capitalist) as well as at home – not to mention continuing concerns about “greenwashing”.

To tackle the latter concern, the FCA recently released a policy paper on its so-called “Sustainability Disclosure Requirements (SDR)” outlining six new rules.

The FCA’s final response includes new measures to support consumers and promote transparency

In November 2023, the FCA released its policy statement on SDR and investment labels. The chancellor used his 2024 Spring Budget to confirm that ESG ratings would soon be FCA regulated to support the new framework.

The three main FCA measures include:

- Anti-greenwashing rules

The FCA’s anti-greenwashing rules apply to all regulated firms and aim to provide reassurance and confidence for you, the consumer.

Under the new rules, all sustainability-related claims made by authorised firms will need to be fair, clear, and not misleading. This means that you can have faith in the communications you receive about the environmental or sustainability characteristics of the products or services recommended to you.

Anti-greenwashing rules and guidance come into force from 31 May 2024.

- 4 new labels

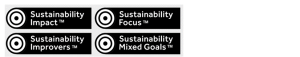

To help consumers navigate the sustainable investment landscape and promote improved trust and transparency, the FCA will introduce four new sustainability labels.

Source: FCA

To be eligible to carry a label, a product must have a clear, specific, and measurable sustainability objective, with at least 70% of its assets invested in line with this aim.

Here’s a brief look at each of the new labels.

- Sustainability Impact

To be eligible for this label, a product must aim to achieve a stated, positive, and measurable impact, environmentally or socially.

Firms will need to explain how they expect their investment activities and products to achieve a positive impact and how this will be measured. They will also need escalation plans in place for what happens if sustainability objectives are not being met.

- Sustainability Focus

The investment will need to be in environmentally or socially sustainable assets, with at least 70% of a Sustainability Focus product’s assets meeting measurable and evidence-based standards.

The remaining 30% cannot conflict with the overall sustainability objective.

- Sustainability Improvers

Products must invest in assets with the potential to improve environmental or social sustainability over time, according to robust and evidence-based standards.

Firms will need to identify when they expect sustainability standards to be reached, as well as producing short- and medium-term targets.

- Sustainability Mixed Goals

Following a consultation, the FCA added a fourth label, for products with a combination of sustainability objectives in line with the other labels.

Companies must be clear about the proportion of assets invested in line with each label, with at least 70% in keeping with the labels’ objectives.

- Naming and marketing rules

New rules will monitor the use of sustainability-related terms, with different rules for products based on whether or not they have a sustainability label attached to them.

Rules will also apply to the naming of products to ensure they accurately reflect that product’s sustainability characteristics. This ensures you know exactly which sustainability criteria you can expect your chosen product to meet.

3 further measures will concentrate on:

- Making consumer-facing information more accessible

- Providing additional and more detailed information for institutional investors and consumers

- Requirements for distributors to ensure product-level information is readily available to consumers

Timescales for changes and what they mean for you

The plans will be implemented over the next three years and could see sweeping changes across the ESG landscape as firms look to adapt and keep pace.

Implementation timescales:

Source: FCA

These rule changes are intended to make sure you have easy access to the information you need to make an informed choice. The rules will challenge firms to be transparent about their sustainable products and make it harder for firms to make exaggerated claims about their ESG credentials.

The FCA hopes that the combined effect will be to improve investor confidence and go some way to repair the damage caused by high-profile greenwashing cases.

Get in touch

To learn more about how our financial planners can help you align your money with your values on ESG and sustainability issues, email us at advise-me@fosterdenovo.com or call us on 0330 332 7866 or book a meeting.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Search

Search