Smart Money September/October

23.09.2024Welcome to our September/October edition of Smart Money.

Smart Money is our client newsletter that is published every other month and covers various financial topics.

On 30th October 2024, Chancellor of the Exchequer Rachel Reeves, will deliver the Autumn Budget Statement 2024. The outcomes of this Autumn Budget will have far-reaching implications, potentially influencing everything from tax rates and public services to business investment and consumer confidence. As such, it is a pivotal moment that will shape the economic landscape in the months and years ahead. Find out in this Smart Money edition what the Budget could mean for your finances.

Also in this edition we look at the implications of early withdrawals and how it can significantly impact retirees’ financial security. More than three-quarters (78%) of retirees have already dipped into their pension pots by the time they retire, according to recent data. Find out more on page 03.

Turn to page 05 to find out essential financial planning tips for mothers balancing finances and family.

On page 06, we explain how understanding the nuances of Inheritance Tax planning, estate planning or intergenerational wealth planning is essential in making informed decisions that could benefit you and your loved ones.

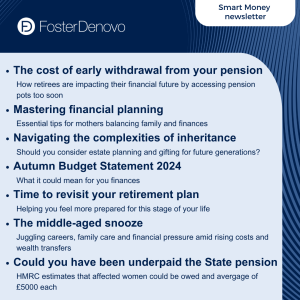

Topics covered:

You can also read previous issues here.

Smart Money September/October 2024

Download the guide.

Get in touch

Whether planning for retirement, investing your money or protecting your wealth, we can assist with every aspect of your financial planning. Contact us today to discuss your specific needs.

Email: advise-me@fosterdenovo.com or Book a meeting

Foster Denovo Private Wealth is a trading name of Foster Denovo Limited, which is authorised and regulated by the Financial Conduct Authority.

A pension is a long-term investment not normally accessible until age 55 (57 from April 2028 unless the plan has a protected pension age).

The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits.

The Financial Conduct Authority doesn’t regulate trust planning and most forms of inheritance tax (IHT) planning.

Some IHT planning solutions put your money at risk, and you may get back less than you invested. IHT thresholds depend on individual circumstances and the law. tax and IHT rules may change in the future.

The tax treatment is dependent on individual circumstances and may be subject to change in future.

Search

Search